Great article by Julie Boatman with FLYING Magazine.

The industry saw more than 10 percent growth overall, with pistons and turboprops the biggest winners.

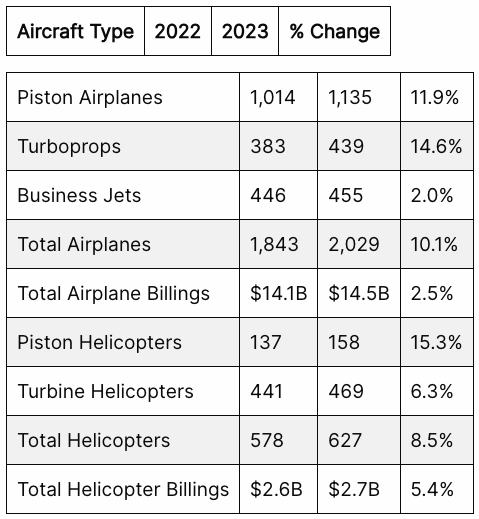

The general aviation market continues its upward trend following the pandemic, according to the latest update from the General Aviation Manufacturers Association. GAMA released its report catching up on the year through the third quarter late Tuesday. Overall, aircraft shipments increased 10.1 percent year over year from 2022. The growth further claws back ground over 2021 and 2020, and continues to gain over 2019 levels.

Total billings are on track to surpass 2022 as well, with $14.478 billion in airplane billings through the third quarter, and $2.695 billion in helicopter billings thus far. Totals through Q3 2022 were $14.117 billion and $2.557 billion, respectively.

Positive upticks in each segment point to the resilience of the OEMs involved, in spite of lingering supply chain and workforce issues, and the compounding global instability wrought by conflict in Eastern Europe and the Middle East. With the recent appointment of a permanent FAA administrator, the industry looks to achieve better results in aircraft certification and other processes requiring agency collaboration and approval.

Jet deliveries rose only slightly through the first nine months of 2023, but Embraer posted significant gains, even ahead of the NBAA-BACE debut of its Phenom 100EX. [Julie Boatman]

“General aviation is the planet’s aerospace technology incubator that drives safety and sustainability benefits to our transportation systems and economies,” said Pete Bunce, GAMA president and CEO, in a statement. “We are laser focused on safety, technology, and sustainability initiatives to maintain and expand our industry’s steadfast growth into the future. To achieve this, it is imperative that there is stability within our industry’s regulatory bodies, and having a new permanent leader at the top of the FAA is a great start. It is also essential that Congress act now to pass an FAA reauthorization bill that provides the new administrator and agency with the necessary direction and tools to strengthen and enhance the aviation system.”

Piston, Turboprop Market Strength

Drivers in the change clearly come from the lighter end of the GA space, with the increase in piston and turboprop shipments for the nine-month period coming in at 11.9 and 14.6 percent, respectively. The major piston OEMs—including Cirrus, Diamond, Piper, Tecnam, and Textron Aviation—are all on track with higher overall deliveries through the third quarter over 2022 totals, with Cirrus marking the largest gains.

On the turboprop side, Epic is still working to improve its production rate, matching last year’s year-to-date Q3 numbers with 10 deliveries thus far. Pilatus has seen the largest gain with 66 units through Q3 versus 47 over the same period, though Daher, Piper, and Textron Aviation have also posted higher numbers against 2022.

Jets Hang On

With a modest increase of 2 percent, the business jet segment has held its own, but marginally. Delays in the certification of the Dassault Falcon 6X, which finally crossed the finish line over the summer, and the Gulfstream G700—which still has not yet secured its FAA TC—provide some clues. Honda Aircraft Company has also come in below last year’s rate, with 12 delivered through Q3 as opposed to 13 through the same period last year of the HA-420. However, Embraer has pushed ahead, with 66 deliveries on the books of the Phenom 100 and 300 series, and Praetor 500/600s.

Nine-Month Aircraft Shipment and Billing (Q1 through Q3)

See the original article here:

https://www.flyingmag.com/gama-numbers-show...

Image: Beechcraft (@beechcraft IG)